As you may already be aware, the process of opening a retail store involves drafting a strong business plan, developing a distinctive brand, arranging your suppliers, and obtaining the capital necessary to realize your idea. However, getting the required license to sell clothes and permits is a crucial step that, if improperly handled, can have a big impact on your success. Before opening to the public, as a retail store owner, you should make sure you are covered by the law to prevent penalties, legal action, and the potential for closure.

Entrepreneurs and business owners have the right to get the licenses and permits required for any business to operate in the United States. The license requirements for the clothing line industry are similar and mostly depend on where your business is located. Since obtaining licenses and permissions for your business requires time and careful adherence to regulations, many entrepreneurs worry about this.

Following extensive study, we have included all of the Licenses Required for Clothing Business to open an apparel store or clothing line.

What Are The Types Of Businesses In The USA?

Proprietorship: An individually owned and operated company. It is the most straightforward and affordable business structure to set up.

Partnership: a company with multiple owners who split the gains and losses. Every partner is personally liable for the debts of the company indefinitely.

LLC: A business structure merging features of corporations and partnerships. In addition to having less liability exposure, LLC members enjoy partnership-like operational freedom and income benefits.

Company: a company that is governed by state law. The name and activities of a corporation are limited by its charter.

S corporations (S-corps): are pass-through businesses that only pay personal income taxes once to the owners and shareholders. Small enterprises are usually S-corps.

Limited liability business: If a limited liability corporation fails, the owner's personal assets, such as their home, car, and bank accounts, are protected.

Cooperative: A cooperative is a privately held business that is run by the same individuals who gain from it. A cooperative's shareholders, who are also its owners, participate in decision-making.

A nonprofit organization: A nonprofit organization works to provide social services or to better the community. Someone must demonstrate to a government agency that their services advance society in order to function under this type of ownership.

Benefit corporation b-corp: Benefit corporations, sometimes known as B corps, seek to make a profit while also helping the public.

A close company: is a business entity owned by a small group of shareholders who are actively engaged in its management and decision-making processes.

C corporation c-corp: A privately held company with an infinite number of stockholders is known as a C corporation. For federal income tax reasons, the majority of large corporations treat themselves as C corporations.

What Are The Key Licenses Required For Clothing Business?

Incorporation Certificate

In the United States, many states require businesses that make goods to register with the state government. Fabric cutting, stitching, and other commercial operations are all part of the manufacturing process. Therefore, before beginning operations, the organization will require the clothing registration certificate.

Business License (or Business Tax Certificate)

You can operate your business anywhere in your city limits if you have a business license. This license is required for almost all business owners. If your firm is located outside of your city lines, you might need to see "County Unincorporated" in several states.

Fictitious Business Name (Doing Business as Statement)

A fictitious business name (DBA) certificate, also known as a Certificate of Assumed Name in some jurisdictions, is required for operating a clothing company under a name different from its registered legal name. Generally speaking, you can submit this certificate with your incorporation paperwork. The legal prerequisites for obtaining this accreditation are frequently simple to adhere to and complete. To comprehend the ramifications of this practice, it is advised that you speak with an attorney or private legal advice.

Employer Identification Number (EIN)

Consider an EIN to be your retail store's equivalent of a Social Security number. All businesses, with the exception of sole proprietorships without staff, require this number, which will be used for tax purposes. Prioritize acquiring this license, as it's frequently needed for business registrations and permits.

Sales and Use Permit (Seller’s Permit)

Since clothing is a taxable product, operating a clothing brand requires both a "Certificate of Authority" and a "Seller's Permit." It allows entrepreneurs to purchase fabric-making raw materials without having to pay sales tax. Additionally, Seller’s permit for clothing line are able to collect sales tax from their clients on apparel sales and submit it to the government.

State Tax Information Forms (Sales Tax License)

The Franchise Tax Board must provide you with the necessary State Income Tax Forms if you sell taxable goods and services. You can obtain a sales tax license by submitting this state tax information form. Additionally, you will need to complete your yearly Business Income Tax Statement (income tax returns) using this sales tax license. You must correctly follow the regulations because sales taxes vary from state to state and even from county to county. For that, you can always ask your revenue officer or country clerk.

Home Occupation Permit

A home occupation permit is necessary for businesses operating from a residential location. A home-based e-commerce business of clothing is not eligible for this license, however it is exempt from commercial taxes. Zoning approval, also known as land use permit, is required for certain businesses. By requesting a zoning approval, you can make sure that your neighborhood is zoned for home businesses and that your company does not violate any parking or noise level restrictions.

Trademark Registration

To secure trademark protection, file an application with the United States Patent and Trademark Office (USPTO) for your clothing brand name. The legal procedure of trademarking a garment brand name typically takes a year or so. Therefore, it is best to begin registering your apparel brand name as soon as possible.

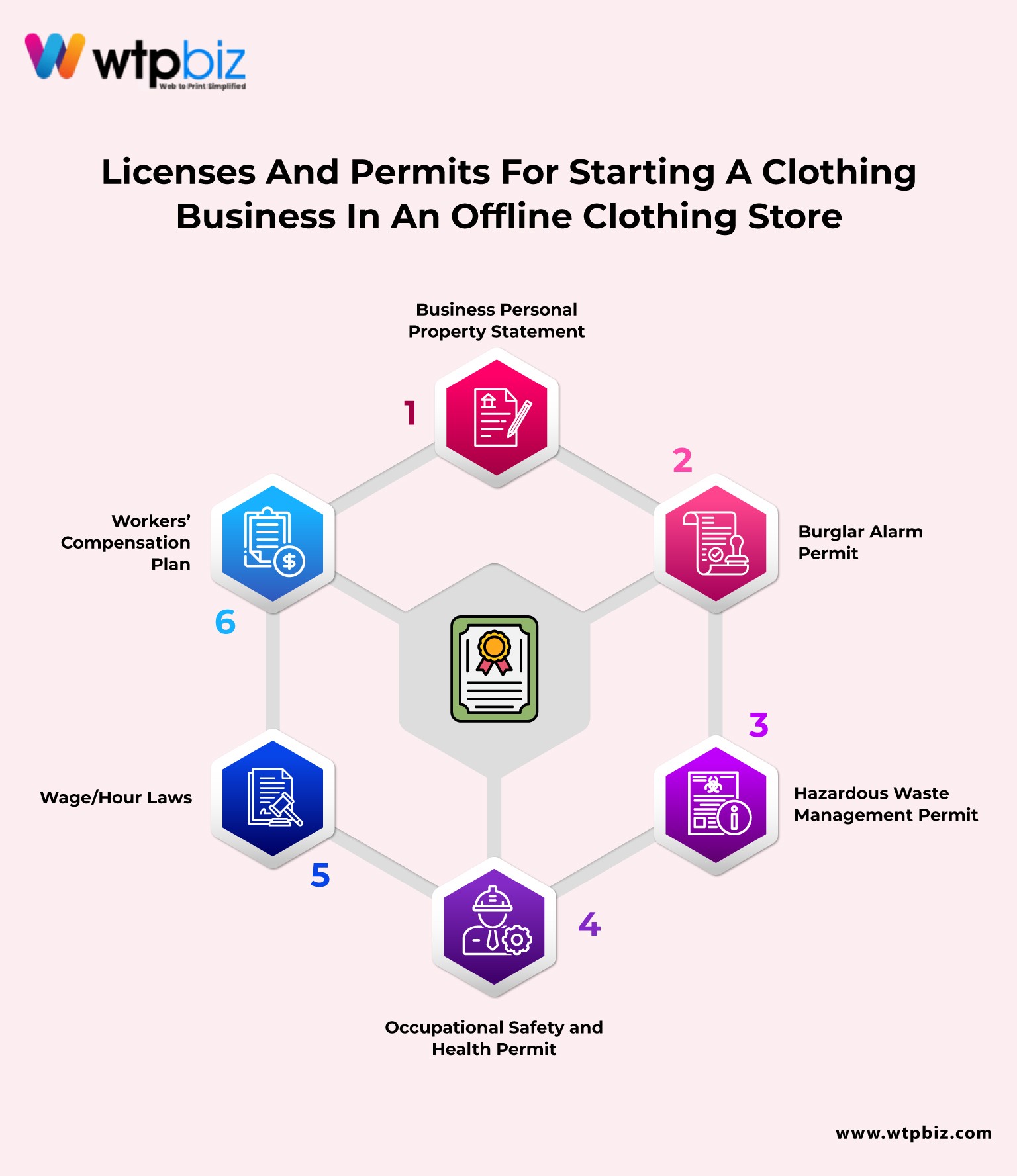

Licenses And Permits For Starting A Clothing Business In An Offline Clothing Store

Business Personal Property Statement

If you have an online store, you may very rarely need to file this annual statement; if you have an offline store, you will undoubtedly need to file it. This is due to the fact that any property you use for commercial purposes, such as trade fixtures, machinery, and equipment, is taxable and subject to assessment. Once more, each state has a different upper limit on the value of real estate.

Burglar Alarm Permit

A permit is necessary if you believe that your clothes business needs a security system for alerts, such as a burglar alarm. You need to get in touch with your state's (or your county's, specifically) police department to obtain this permit.

Hazardous Waste Management Permit

You must have the Environmental Department's approval before handling any hazardous materials, producing or treating hazardous waste, or storing it above ground in your store or in subterranean storage tanks. You can visit the fire department in your county or state to find out the laws and regulations governing this permit, which is subject to local CUPA/HMUPA.

Occupational Safety and Health Permit

You need to have an Injury or Illness Prevention Plan in place if your store employs people. To find out how you can help employees prevent workplace dangers or harmful working circumstances, your state provides a free consultation service.

Wage/Hour Laws

Wage/Hour Laws are the rules and regulations that you must go by, which set minimum requirements for wages, hours, and working conditions. They are not technically permitted. To make sure you follow all of the rules and regulations, get in touch with your city's Labor Commission office.

Workers’ Compensation Plan

Firms employing employees, especially offline firms, must have Workers' Compensation Insurance coverage. The State Workers' Compensation Insurance Fund, a commercial carrier, or self-insurance are the three options available to them.

Conclusion

Getting the Licenses Required for Clothing Business is necessary for both new businesses and established companies hoping to succeed in the cutthroat retail industry of today. A clothes line firm can operate anywhere in the United States thanks to the legal documentation. As a result, they hold considerable importance in the company's operational activities.. Thus all the companies need to follow Clothing business compliance USA.

With different license fees and taxes, every business kind has advantages and disadvantages. To assist you choose Licenses Required for Clothing Business you want to start and to understand what to anticipate in the future, it is recommended that you speak with an expert. Additionally, it will decide whether you must file a paper at the state or national level.

FAQs

What licenses are required to start a clothing line business in the USA?

As mentioned above, Employer identification number (EIN), home occupation permit, seller's permit, apparel registration certificate, general business license and business insurance.

What is a seller’s permit, and why do I need it for my clothing line?

A seller's permit is a special number that enables a company to collect sales tax on goods sold online or in-store. turns the company into a go-between for the government and its clients. requires the company to submit state tax and sales tax filings to the government on a regular basis.

Do I need a trademark for my clothing line business?

In order to prevent others from adopting identical branding that could mislead customers and damage your reputation, it is imperative that you register a trademark for your company if you wish to protect the brand identification of your clothing line, including your name, logo, or slogan.

How do I apply for the necessary licenses and permits for my clothing business?

For advice and details on the requirements for your company, contact the office of your local state or municipal government. You might also require additional online licenses and permits based on your business operations.

How much do licenses and permits for a clothing business cost?

Depending on the state or province, obtaining licenses and permissions for a clothes business might cost anywhere from $1,000 to $5,000. Businesses that sell goods online must obtain online seller permits, which can range from $20 to $100.

FAQs